ONE OF THE MOST PROFITABLE SALE IN MY CAREER FOR MY CLIENT. Purchased S$10.3 Million and Sold S$37 Million in about 6 Years Holding.

LATEST UPDATE . IN COLLABORATION WITH BOULEVARD.CO

Media Coverage : For Your References -THE SHOPHOUSE PORTFOLIO GALLERY- SOLD BY ME LAST 30 YEARS… with 5 Boutique Hotels Sold…….

Appeared On The Edge Magazine

ANSON HOUSE SOLD BY ME IN 2009

Anson House put up for sale for $175-180m

Kalpana Rashiwala

The Business Times

Saturday, Feb 08, 2014

IT seems Anson House finds a new owner every two or three years. Its current owner, CBRE Global Investors, is understood to have put the 13-storey office block up for sale, with an indicative pricing of $175-180 million.

That would translate to $2,292-2,357 per square foot on net lettable area (NLA) of 76,362 sq ft for the building, which is on a site with about 82 years of remaining lease.

About 20 per cent of the building is currently vacant, which allows for a potential occupier seeking to partly occupy the building as well as provision for signage and naming rights.

Based on existing leases, the average passing rent is about $8 per square foot per month. Recently inked leases in the building have been at $8.50-$9.50 psf per month.

On a fully leased basis, the net yield is expected to be around 3.5-3.75 per cent.

Besides a potential part occupier that may be keen on naming rights as well, Anson House may also appeal to core property funds looking for steady rental income stream from an asset that does not require refurbishment.

Adding to this appeal is the relatively “bite size” pricing, in the $100-200 million range. Potential strata subdivision of the building, subject to approval from the authorities, could provide another angle for a buyer, who could then sell the individual units. The building has about 7,000 sq ft of space per floor, with three to four tenants on some floors.

Major tenants include ArcelorMittal and United Technologies.

Anson House boasts a high floor-to-ceiling height of 3.4 metres, compared with the typical 2.9 metres for some newer office developments. In addition, it has 103 car parking lots reflecting a ratio of one car park lot for every 936 sq ft of gross floor area, one of the highest in the CBD.

SEE IN BOLD – HISTORICAL LAND PTE LTD BROKERED THE DEAL – $85 MILLION

I put it here to show how interesting this property from $85 Million to finally now SEB owns it $172M wow…

I manage to get a few Ultra UHNW to buy it in 2009 for $85 Million. They sold it at $146m as I can remember.

Real Estate

Home > Real Estate > Story

Shophouse deals down but prices stay resilient

Prices in choice CBD locations defy expectations by rising, those outside Central Area soften

By

Kalpana Rashiwala kalpana@sph.com.sg@KalpanaBT

PROPOSITION: ‘By renovating properties, rents go up and hence prices increase,’ says Zain Fancy of Clifton Real Estate

13 Dec5:50 AM

Singapore

THE number and value of shophouse transactions so far this year is roughly half that of last year, as demand has been hit by tightened availability of loans, a compression of shophouse yields and investor interest being diverted to overseas properties.

Prices in choice locations in the Central Business District, however, are still holding given the limited supply and the profile of owners, mostly deep-pocketed investors that are happy to continue renting out their premises if they cannot reap significant capital appreciation.

CBRE’s analysis of URA Realis data shows that 101 caveats have been lodged for shophouse transactions so far this year totalling S$548 million, down from 206 caveats adding up to S$1.27 billion in 2013

In the first half of last year, S$922 million worth of shophouses changed hands; however the onset of the total debt servicing ratio (TDSR) framework in late-June 2013 has caused some buyers to hold back their purchase plans.

Shophouse sales slipped to S$347 milion in the second half of 2013 before easing further to S$277 million in H1 this year and S$271 million so far this half. However, these figures do not include deals involving sales of shares in special purpose vehicle companies that own shophouse assets, since caveats are typically not lodged for such deals. An example would be a S$50 million sale of a row of five shophouses in the CBD this year.

A shophouse in Boat Quay is understood to have been sold recently for S$9.5 million – which has not been caveated.

Owners who want to sell shophouses may have had to clip their pricing expectations, say property agents, but actual transacted prices have been resilient in districts 1 and 2, where the choicest conservation shophouse stock is located, such as Telok Ayer Street, Club Street, Amoy Street, Chinatown, Duxton Hill and Tanjong Pagar.

“However, shophouse prices outside the Central Area in places such as Geylang, East Coast and Upper Serangoon have softened about 5-10 per cent (post-TDSR).”

Simon Monteiro, director at LIST SOTHEBYS , a boutique property agency specialising in shophouses, observed that “those who are selling shophouses currently are the ones looking to divest a few small shophouses in various locations and replacing them with a bigger investment, for example, a row of shophouses; or some investors who just want to cash out now for retirement reasons”.

Even after the TDSR rollout, a few investors have managed to realise attractive gains from shophouses. For example, a property in Peck Seah Street was acquired in March last year for S$12.2 million and resold four months later (before the completion of the sale) for S$16.8 million before being flipped again in October the same year for S$20.5 million.

Such cases are rare though. Most of those making sizeable gains have longer holding periods. For instance, a property on Tras Street that was sold two months ago for S$11.15 million had previously changed hands for S$7.1 million in May 2012 and prior to that for S$5 million in July 2010, according to caveats data.

Mr Monteiro notes that most shophouses are held by ultra high net worth (UHNW) owners with very good holding power. “For them to sell, the values must double or more.”

Agreeing, Knight Frank executive director (investment) Mary Sai, said: “There are owners telling us: ‘If I don’t get my price, I’ll just rent it out.”

Yields on shophouses have declined as rental increases have not kept pace with the jumps in capital values.

“Net yields today are around 2-2.5 per cent on average on commercial shophouses in Districts 1 and 2,” said Ms Sai. “In Q1 2013, they used to be 3-3.5 per cent.”

Mr Monteiro said that current sub-3 per cent yields are “rather unattractive to investors”. “If you are a serious seller, you may have to lower your price expectations to allow the yield to the buyer to be 3-3.5 per cent. Only then will you see interest.”

Industry players note that buyers are also factoring in expected increases in borrowing costs.

Ms Sai said that a common strategy by landlords is to lease out the ground floor to a food and beverage (F&B) outlet or as a showroom, and find office tenants for the uppper floors.

The increase in Grade A office rents has helped to prop up office rents in shophouses.

“Landlords try to maximise their rental returns by having one tenant per floor to avoid having to give a bulk discount to a single tenant occupying the whole building,” Ms Sai added.

Investors that acquired shophouses more than five years ago would be able to comfortably service their mortgage from rental collection as their purchase price would be much lower than current values, she said. “But those who bought 1-2 years ago, I think, to their horror, some of them find they cannot push up the rental much if the rent at the point when they bought their property was already quite peakish. If they trigger any further increases, their tenants may not find it sustainable to continue business at the location.”

On the other hand, Zain Fancy, founder and director of Clifton Real Estate, which owns more than a dozen shophouses in Singapore, pointed out that it is still possible to spot good investment opportunities. “A lot of shophouses are under-rented; their owners have not spruced up the properties in years. So there is a value proposition here.

“By renovating properties, rents go up and hence prices increase. From the tenants’ perspective, renting space in a shophouse can be attractive. For instance, we’re leasing ground floor retail space at Pagoda Street, a location with very high foot traffic, at S$17-18 psf a month – a discount to the S$35-40 psf for ground floor space in an Orchard Road mall.

“We have leased an upper-level office floor (of about 1,200 sq ft) in one of our CBD shophouses at S$8 psf, so that’s about S$10,000 monthly rent – and they get their own toilet and pantry. The occupier is new to Singapore and was previously operating out of a serviced office, paying about S$5,000 a month for a space of about 100 sq ft.”

Ms Sai too noted that the average shophouse office rent in the CBD of about S$6-6.50 psf a month is lower than the double-digit rents in Grade A office buildings.

Street-level F&B space has been the key driver for growth of shophouse rents, noted Mr Monteiro. “There has been an influx of cafes and restaurants in conservation shophouses in the CBD for example in the Duxton, Keong Saik and Gemmill Lane locales, for instance, in the past four or five years.”

Currently, approval from the Urban Redevelopment Authority (URA) for “eating houses”, the planning term for F&B use, is granted on Temporary Permission of one to three years.

However, Mr Monteiro cautions that “that there may come a time when, to maintain a mix of trades in the conservation districts, URA may limit approvals for F&B use in shophouses even in the CBD”. This could potentially cause a reversal of interest in commmercial shophouses, he added.

Another reason for thinning of shophouse transactions is that some property investors have been moving away from the Singapore scene in search of higher yields, say agents.

Still, Singapore shophouses have their attractions. “Funds and UHNW investors, mainly foreigners, are among the buyers,” said Mr Monteiro. Investors switching from the residential segment, which has been hit by cooling measures, also find commercial shophouses an attractive alternative. There are no restrictions on foreign ownership of shophouses on sites fully zoned commercial.

Ms Sai points out that despite the already sharp price appreciation, a shophouse investor paying, say, S$2,500 to S$2,800 psf on GFA in the CBD will feel comforted knowing that it is still cheaper than the S$3,000-4,000 psf on average for new strata retail units in city-fringe locations and at least S$3,000 psf for new strata offices in the financial district.

Agents say that prices of shophouses in districts 1 and 2 will continue to be supported by the fact that they are mostly well located – in the business district and near an MRT station.

There is also an increase in demand from end-users looking to buy and occupy a shophouse for their own business instead of leasing it out, said CBRE’s Ms Lim. “These properties are a limited-edition asset class as they are designed with a distinctive facade, possess a unique charm and are steeped in history. Shophouses will continue to be highly sought after. Transaction values and volumes are projected to increase about 10 per cent in 2015.”

Ms Sai too expects the pricing outlook for districts 1 and 2 shophouses to remain resilient next year. “But other areas including Little India (District 8) and non-central locations may succumb to the impact of TDSR and the economic situation.”

Source : http://www.businesstimes.com.sg/real-estate/shophouse-deals-down-but-prices-stay-resilient

The Straits Times – October 18, 2014 By: CHERYL ONG

Between $14 million and $18 million each: Four units in Pagoda Street. — PHOTO: LIM YAOHUI FOR THE STRAITS TIMES

SHOPHOUSES are fast emerging as an attractive prospect for investors confronted by dwindling investment opportunities in a downbeat property market.

While the residential market is now a pale shadow of itself from two years ago, deals in the shophouse space have picked up.

Just this month, two units at 10 and 12 Gemmill Lane changed hands for $10 million, according to sources. A 99-year leasehold unit at nearby 22 Gemmill Lane was also sold for $14 million at about the same time.

Based on the built-up area, the price works out to about $2,000 to $2,300 per sq ft (psf) each.

At least four units in Pagoda Street were snapped up for between $14 and $18 million each this week. Caveats from the Urban Redevelopment Authority revealed that one unit at 16 Gemmill Lane changed hands for $10.5 million last month and another one at 43 Keong Saik Road went for $7.8 million in August.

Shophouses, which are limited in supply, have traditionally been held by owners who inherited them and feel no pressure to sell. The units are therefore harder to buy, experts said.

But the landscape is fast changing, with investors jumping into the commercial market after eight rounds of cooling measures and stringent mortgage lending rules squeezed many out of the residential segment.

Shophouses are popular with foreign buyers as they do not face restrictions such as the additional buyer’s stamp duty, unlike in the residential segment.

Also, conserved shophouses are concentrated in the prime Central Business District (CBD) and offer a cultural charm, said Mr Tan.

Mr Zain Fancy, founder of Clifton Real Estate Group, a firm investing mainly in shophouses, said the main draw is in “restoring units to their former glory”.

“It’s like owning a landed property with your own building with a piece of Singapore history.”

URA data, based on land area, shows median prices of shophouses have surged by 50 per cent to $3,412 psf in the last two years.

“Generally, people who buy shophouses believe in capital appreciation. Shophouse rents have not moved as fast as capital values,” said Mr Ian Loh, director and head of investment and capital markets at Knight Frank.

One drawback cited by industry players is that information on the units’ built-up areas and rents is not freely available, resulting in a market that is still fragmented.

So landlords have not raised rents in line with the market, said Mr Tan. But this represents potentially better rental yields.

He cited a tenant who recently renewed a lease at $29,000 for a 4,000 sq ft three-storey shophouse in Tanjong Pagar – up from $18,000 three years ago.

Ms Chia Siew Chuin, director of research and advisory at Colliers, said shophouses have become popular with food and beverage outlets, budget hotels and even firms that do not require Grade A office space. CBD office rents can fall between $7 psf for older buildings and $12.50 psf in the Marina Bay financial district.

However, Mr Loh noted that shophouses are costlier to invest in, compared with other commercial assets such as strata office or retail space. A conserved shophouse in the CBD, for instance, can cost at least $7 million.

22 GEMMILL LANE WAS SOLD BY SIMON MONTEIRO ( HISTORICAL LAND PTE LTD ) FOR $14.25M

July 4 2014

Business Times

$22m price tag for 5 shophouses

KALPANA RASHIWALA

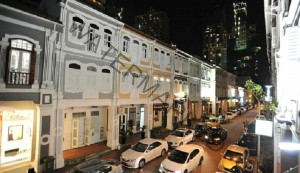

FIVE adjoining shophouse properties in Club Street have been put on the market with an asking price of $22 million.They comprise Nos. 1, 3 and 5 Club Street, which are three storeys high and have an attic, and Nos. 7 and 9, which are two storeys high. All five have a remaining land tenure of about 80 years.

The properties are being marketed jointly by JLL and Historical Land. The latter is a boutique property agency specialising in shophouses.

The shophouses are being offered as a package. Nos. 1, 3 and 5 are owned by Citystate Properties while Nos. 7 and 9 are owned by Dr Ling Ai Ee, who is also one of the shareholders of Citystate Properties.

The $22 million asking price translates to $3,230 per sq ft of floor area of about 6,800 sq ft. The shophouses are currently leased, with insurance company EQ occupying the ground level. The upper levels are leased out as residences.

A strong attraction of the properties is that they are part of a stretch of Club Street and Gemmill Lane that was recently re-zoned for commercial use under the Urban Redevelopment Authority’s (URA’s) Master Plan 2014. The stretch was previously zoned as “residential with first-storey commercial”.

In a circular issued on June 10, URA said the zoning change is consistent with the commercial zoning for the rest of the shophouses in Club Street.

Historical Land director Simon Monteiro said: “With full commercial zoning, this means foreigners are now eligible to buy these shophouses.”

Foreigners require the approval of the Land Dealings (Approval) Unit of the Singapore Land Authority to purchase an entire shophouse on a site zoned for residential use, although they may buy a unit within a strata-subdivided shophouse building on residential-zoned land.

“In addition to offering prime frontage at the Club Street/Cross Street corner, a stone’s throw from the Telok Ayer MRT station on the Downtown Line, these five shophouses make up a rare island-site in the popular Club Street locale which is steeped in history,” added Mr Monteiro.

Club Street was the last part of Chinatown to be developed, beginning in the early 1890s, according to architecture historian Julian Davison, who traced the provenance of the five properties for Historical Land.

The shophouses on offer comprise two separate developments: Nos. 7 and 9, which were most likely built in the late 19th century, and Nos. 1, 3 and 5, which were built by business magnate Ezekiel Saleh Manasseh in 1924-1925. A leading businessman and property developer, Mr Manasseh commissioned the architectural firm of Westerhout & Oman to build the three shophouses.

The principal feature of the front facade is the central airwell. There is also a cantilevered balcony halfway up, as well as a star-shaped pediment on top, intended to recall the Jewish Star of David, wrote Dr Davison.

THE BUSINESS TIMES

Tras Street sheds dingy image with new bars and eateries

Tras Street at Tanjong Pagar Road has shed its dingy image with new bars and restaurants lining it

Published on May 18, 2014 12:21 PM

Along Tras Street, you will find food and beverage establishments such as Cafe Gavroche, Gattopardo Ristorante Di Mare and Buttero. — PHOTO: LIM YAOHUI FOR THE SUNDAY TIMES

By Rebecca Lynne Tan, Food Correspondent

Tras Street, the once dingy and slightly notorious street off Tanjong Pagar Road, has transformed into a thriving food and beverage neighbourhood.

Bustling restaurants and trendy cocktail bars are now located alongside advertising offices, yoga studios and fund management firms. Only a few KTV bars still remain on the conservation shophouse-lined street.

About 13 food and beverage outlets, excluding karaoke bars, now line the part of Tras Street between Cook and Wallich streets.

This is a far cry from the food offerings there three to four years ago.

Back then, the street was known mostly for popular late-night Korean fried chicken restaurant Kko Kko Nara, and the now-defunct European restaurant Table 66, which relocated in 2011 to Winstedt Road and relaunched itself as Skyve Wine Bistro.

Now, the street is home to two French restaurants – 2-1/2-year-old Brasserie Gavroche and eight-month-old Fleur De Sel; two cocktail bars – House Of Dandy and Jekyll & Hyde; cafe-bar Cafe Gavroche; year-old Japanese restaurant Sushi Mitsuya; and private dining and cooking studio My Private Chef.

More recent entrants include Spanish tapas and sake bar BAM!, which opened in December last year; and Sicilian seafood restaurant Gattopardo Ristorante Di Mare, which relocated there from Hotel Fort Canning in January.

The newest restaurant on the block opened three weeks ago. Buttero – which is headed and co-owned by Logan Campbell, 36, a New Zealand-born chef who used to head Lucio’s, one of Sydney’s best-known and established Italian restaurants – serves rustic Italian fare including pastas, as well as barbecued and grilled meats.

Restaurateurs and real-estate management companies say more food and beverage outlets are slated to open in this part of Tras Street soon.

The area is flanked by a myriad of other food and beverage offerings, from the Japanese eateries at Orchid Hotel, to the restaurants and bars at Icon Village, to others at 100AM mall and along Tanjong Pagar Road.

Restaurateurs and cocktail bar owners SundayLife! spoke to say they were drawn to the street for several reasons.

One is the area’s proximity to the Central Business District, as well as to residential, commercial and hotel properties. For instance, the street is a stone’s throw from Orchid Hotel, Amara Singapore and the recently opened Carlton City Hotel. Another hotel, Oasia, is also being developed.

The restaurants target mainly discerning diners from the corporate sector. So the location makes it more convenient for customers to dine there, restaurateurs say.

Also, many of the chefs who have set up restaurants in the street have their own following, having previously worked at top hotels and restaurants in Singapore.

Other pull factors include the reasonable rentals and the conservation area’s charm.

The fact that it is also located away from the hustle and bustle of the main road also gives the street exclusivity, restaurateurs say.

Many also cite the potential they see in the area, given that it is the quietest and least developed of the trendy Chinatown triangle, which includes popular food and beverage enclaves such as Keong Saik Road, Duxton Hill and Road, and the Club Street and Ann Siang Hill areas.

Buttero’s chef Campbell says: “I think there is room for everyone. And I like the fact that the street is a little bit gritty. I like being off the main area and being a dirty little secret.”

Mr Jeff Ho, 37, co-owner of cocktail bar Jekyll & Hyde, says: “It was relatively under-developed and we saw an opportunity as we felt we could help improve the vibe of the area.”

Rental rates, he adds, are also reasonable. When an area is too crowded and popular, rentals tend to be driven up, he says.

A SundayLife! check with restaurateurs, real-estate agents and property management companies found that rentals range from about $7 to $10 per square feet (psf), up from about $6 psf about two years ago.

In the Duxton Road and Hill, and in the Club Street and Ann Siang Hill areas, rentals can range between $10 and $15 psf.

Mr Simon Monteiro, 47, a conservation shophouse specialist who also deals in real estate, says he has seen the area blossom since he started dealing with properties in the historic neighbourhood 17 years ago.

He says: “It was only in the last two to three years that the street started to develop. It used to be littered with pubs, but that has changed.”

Ms Krystal Khor, 41, of real estate and property management company Mondania, which manages about half of the properties in Tras Street, says her company has been “working for many years to bring up the standard of tenants in the street”. She has been working with properties in the street since 2007.

She says: “We try our best to bring in a good profile of tenants. If all the units are rented out to food and beverage businesses that will not be a good thing either. We are selective as we do not want our tenants to cannibalise one another.”

Indeed, ask restaurant and bar owners about the competition among them, and they will say otherwise.

In fact, it there is more camaraderie than competition among food and beverage business owners here.

Jekyll & Hyde’s Mr Ho says he has lent chairs to BAM!, while House Of Dandy’s owner Guy MacGregor says Cafe and Brasserie Gavroche have helped serve food when his bar has run out.

Owners are more than willing to send a bucket of ice across the street when one of their compatriots runs out.

Feel like having a different style of cocktail or a particular spirit? Head to the other cocktail bar down the road.

Mr Lino Sauro, 44, chef-owner of Gattopardo, says: “We (the chefs) all knew each other from before. All of us offer a different type of cuisine and we cannot be happier to create an amazing and unique gastronomic corner in an already super saturated dining scene in Singapore.”

Brasserie Gavroche and Cafe Gavroche’s chef-owner Frederic Colin, 40, adds: “We recommend diners to other restaurants and to have drinks at the cocktail bars, we complement one another with the quality and variety of restaurants in Tras Street.”

Tras Street was named in 1898 after a Malaysian town, according to the National Library Board’s Infopedia.

Located on the fringe of Chinatown and away from the main thoroughfare of Tanjong Pagar Road, it was lined with homes and businesses in the early days.

While other parts of the historic neighbourhood flourished, Tras Street mostly remained quiet. Still, it seems notoriety has plagued the street throughout the years.

Thugs with parangs smashed a coffee shop in 1961, while in the mid-noughties, KTV hostesses were nabbed on suspicion of consuming drugs.

A semi-retired clothing business owner who declined to be named and who has owned “a couple of shophouses” in Tras Street since the early 1990s, says the street was a “sleepy” one. It housed mostly trading and commodity businesses.

The sleazy KTV bars started moving in in the late 1990s but the street has “cleaned up” and most have moved out, he says.

These days, in fact, the street is often abuzz with diners and those after pre- or post-dinner tipples. In fact, it is not uncommon to see people walking in the middle of the one-way street, and hopping from a restaurant to a bar, or chatting outside the food and beverage establishments.

Buttero’s chef Campbell says the street would be perfect for a “street party”.

He says: “We could have a block party or a festival where each restaurant could serve its signature dish. Each of the restaurants has something different and interesting to offer.”

But food and beverage operators here are quick to add that they may not be keen for the street to turn into the next Club Street, which is known for being lively and having a high volume of diners and drinkers.

They say the influx of too many food and beverage businesses would make the street too saturated, which could in turn take away the street’s charm and exclusivity.

Alexandre Lozachmeur, 34, chef-owner of Fleur De Sel, says “people bring people”, which has helped to improve the reputation of food and beverage outlets in the street.He says: “The street has become a destination, and more people are beginning to talk about Tras Street but if the street becomes like Club Street, it might be a little too much.”

Simon Monteiro is quoted here in these articles.

I regularly give my views about the Heritage Real Estate Market

TO HAVE A COFFEE WITH ME +65 9010 1024